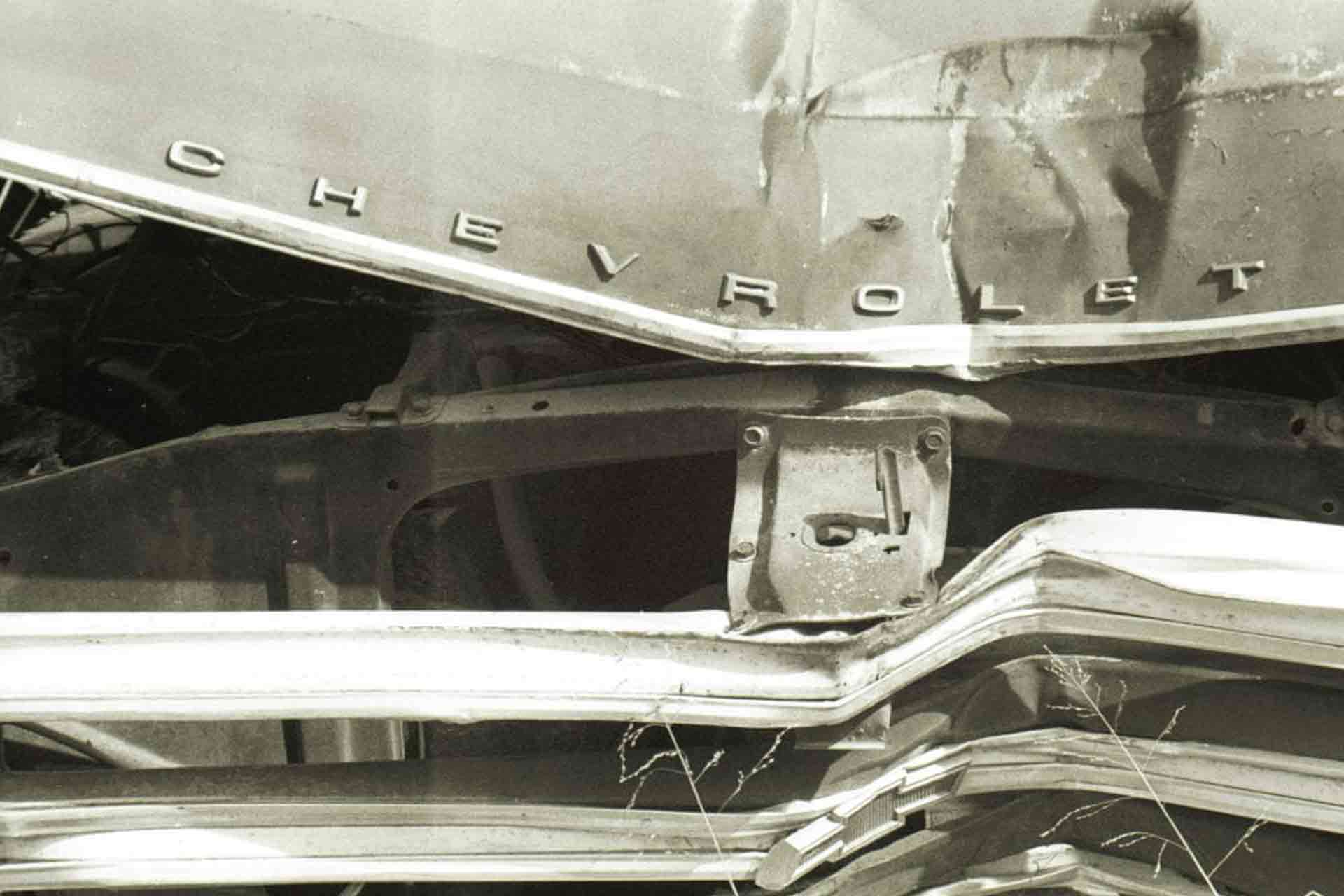

If you would like to get a fair settlement for the total loss of your auto, you have found the right article. It will take a little work, but I think I can shed a little light on what you need to know in order to get a fair settlement.

As the owner of an appraisal and claim service company as well as a former licensed adjuster who has settled thousands of total loss claims, I will reveal the tricks to getting an insurance company to take you seriously.

In this article, I will dispel common misconceptions on total losses, tell you how to argue with computer programs and formulas, and give step-by-step instructions on how to best support your claim to get it settled.